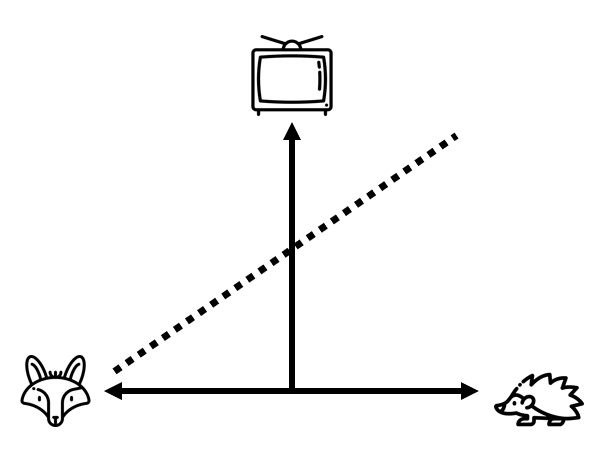

Personen mit einfachen Antworten (Igel-Denken) erhalten mehr (Medien-)Aufmerksamkeit |  |

Diese Seite wurde seit 5 Jahren inhaltlich nicht mehr aktualisiert.

Unter Umständen ist sie nicht mehr aktuell.

Diese Seite wurde seit 5 Jahren inhaltlich nicht mehr aktualisiert.

Unter Umständen ist sie nicht mehr aktuell.

Definitionen

Definitionen

Von Nate Silver im Buch The Signal and the Noise (2012) im Text Sind Sie schlauer als der Experte im Fernsehen?

Bemerkungen

Bemerkungen

»Was veranlasst einen Intellektuellen, öffentlich aufzutreten?«, fragte mich Tetlock. »Es gibt Akademiker, die sich mit relativer Anonymität begnügen. Aber es gibt auch die anderen, deren Wunsch es ist, als Intellektuelle öffentlich in Erscheinung zu treten. Nicht vernachlässigbare Wahrscheinlichkeiten mit dramatischen Veränderungen in Verbindung zu bringen, garantiert ein gewisses allgemeines Interesse.«

»Was veranlasst einen Intellektuellen, öffentlich aufzutreten?«, fragte mich Tetlock. »Es gibt Akademiker, die sich mit relativer Anonymität begnügen. Aber es gibt auch die anderen, deren Wunsch es ist, als Intellektuelle öffentlich in Erscheinung zu treten. Nicht vernachlässigbare Wahrscheinlichkeiten mit dramatischen Veränderungen in Verbindung zu bringen, garantiert ein gewisses allgemeines Interesse.« Füchsen fällt es manchmal schwerer, sich in der Welt des Fernsehens, des Geschäftslebens und der Politik zurechtzufinden. Ihre Überzeugung, dass sich viele Probleme schlecht vorhersagen lassen – und dass man diese Unsicherheiten auch aussprechen sollte –, werden fälschlicherweise für mangelndes Selbstbewusstsein gehalten. Ihr pluralistischer Ansatz gilt als Mangel an Überzeugung. Harry Truman wurde mit seiner Forderung nach einem »einhändigen« Ökonomen berühmt; er war verärgert darüber, dass ihm die Füchse in seiner Regierung keine einfachen Antworten geben konnten.

Füchsen fällt es manchmal schwerer, sich in der Welt des Fernsehens, des Geschäftslebens und der Politik zurechtzufinden. Ihre Überzeugung, dass sich viele Probleme schlecht vorhersagen lassen – und dass man diese Unsicherheiten auch aussprechen sollte –, werden fälschlicherweise für mangelndes Selbstbewusstsein gehalten. Ihr pluralistischer Ansatz gilt als Mangel an Überzeugung. Harry Truman wurde mit seiner Forderung nach einem »einhändigen« Ökonomen berühmt; er war verärgert darüber, dass ihm die Füchse in seiner Regierung keine einfachen Antworten geben konnten.Who was more famous? The hedgehog. Phil found that there

is an inverse correlation between fame and accuracy. Stop and think about that for a moment. Isn’t that just

amazing? Now, why is that? I’m guessing that German television has exposed you to both such creatures. – Who

makes better television, the fox or the hedgehog? If you’re a TV producer, who do you want as your guest? You

want the hedgehog. The hedgehog tells a simple, clear story. The fox is like, „I’m not sure…“ If you’re a producer,

you don’t want this. Which is why, when you turn on CNBC, it’s a parade of hedgehogs. That’s great television.

Von Dan Gardner im Text Turning Future Babble Into Real Foresight (2014) The question is: Why is it great television? And I think part of the answer can

be illustrated this way: President Harry Truman said that he wanted to hear from a „one-armed economist“,

because he was sick of hearing, „One the one hand … one the other hand …“ That is human nature. When you

have a really important question, you want an answer. And when someone comes along and says, „Well, I think

there are six factors involved, maybe seven. On the one hand, some of them point in this direction. On the other

hand, some of them point in that direction. Balance of probability says it’s probably more likely than not that it’s

going to go this way, but there’s upside risk, and there’s downside risk, and …“ There’s steam coming out of your

ears at this point. You want an answer. And a probability judgment doesn’t feel like an answer because it says,

„I’m not sure“. I mean, that’s fundamentally what a probability judgment is. It’s an expression, „I think, but I’m not

sure“. That’s not good enough. You want to hear an answer! You want the one-armed economist!

Von Dan Gardner im Text Turning Future Babble Into Real Foresight (2014)  That too is consistent with the EPJ

data, which revealed an inverse correlation between fame and accuracy: the more

famous an expert was, the less accurate he was. That’s not because editors,

producers, and the public go looking for bad forecasters. They go looking for

hedgehogs, who just happen to be bad forecasters. Animated by a Big Idea,

hedgehogs tell tight, simple, clear stories that grab and hold audiences. As anyone

who has done media training knows, the first rule is “keep it simple, stupid.” Better

still, hedgehogs are confident. With their one-perspective analysis, hedgehogs can

pile up reasons why they are right—“furthermore,” “moreover”—without

considering other perspectives and the pesky doubts and caveats they raise. And so,

as EPJ showed, hedgehogs are likelier to say something definitely will or won’t

happen. For many audiences, that’s satisfying. People tend to find uncertainty

disturbing and “maybe” underscores uncertainty with a bright red crayon. The

simplicity and confidence of the hedgehog impairs foresight, but it calms nerves—

which is good for the careers of hedgehogs.

That too is consistent with the EPJ

data, which revealed an inverse correlation between fame and accuracy: the more

famous an expert was, the less accurate he was. That’s not because editors,

producers, and the public go looking for bad forecasters. They go looking for

hedgehogs, who just happen to be bad forecasters. Animated by a Big Idea,

hedgehogs tell tight, simple, clear stories that grab and hold audiences. As anyone

who has done media training knows, the first rule is “keep it simple, stupid.” Better

still, hedgehogs are confident. With their one-perspective analysis, hedgehogs can

pile up reasons why they are right—“furthermore,” “moreover”—without

considering other perspectives and the pesky doubts and caveats they raise. And so,

as EPJ showed, hedgehogs are likelier to say something definitely will or won’t

happen. For many audiences, that’s satisfying. People tend to find uncertainty

disturbing and “maybe” underscores uncertainty with a bright red crayon. The

simplicity and confidence of the hedgehog impairs foresight, but it calms nerves—

which is good for the careers of hedgehogs.Foxes don’t fare so well in the media. They’re less confident, less likely to say something is “certain” or “impossible,” and are likelier to settle on shades of “maybe.” And their stories are complex, full of “howevers” and “on the other hands,” because they look at problems one way, then another, and another. This aggregation of many perspectives is bad TV. But it’s good forecasting. Indeed, it’s essential.

Zitationsgraph

Zitationsgraph

Zitationsgraph (Beta-Test mit vis.js)

Zitationsgraph (Beta-Test mit vis.js)

3 Erwähnungen

3 Erwähnungen

- The Signal and the Noise (Nate Silver) (2012)

- Turning Future Babble Into Real Foresight (Dan Gardner) (2014)

- Superforcasting - The Art and Science of Prediction (Philip E. Tetlock, Dan Gardner) (2015)

Biblionetz-History

Biblionetz-History